Contribution Margin Is Best Described as:

Rate of return on investment. The contribution margin is the dollar amount of per unit revenue that contributes to profit.

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

Cash flow is best described as.

. Chapter 11 Contribution margin is best described as. For example if the price of your product is 20 and the unit variable cost is 4 then the unit contribution margin is 16. Definition of Contribution Margin.

The contribution margin is computed as the difference between sales revenue and fixed costs. Contribution margin is the amount left-over after deducting from the revenue the direct and indirect variable costs incurred in earning that revenue. Contribution Margin.

What is the Contribution Margin. Revenues minus variable expenses. The contribution margin tells us how much of the revenues will be available after the variable expenses are covered for the fixed expenses and net income.

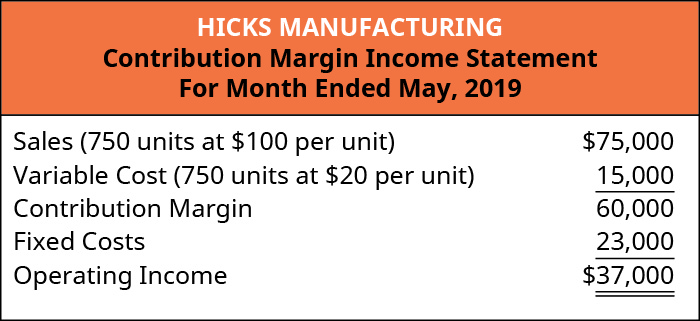

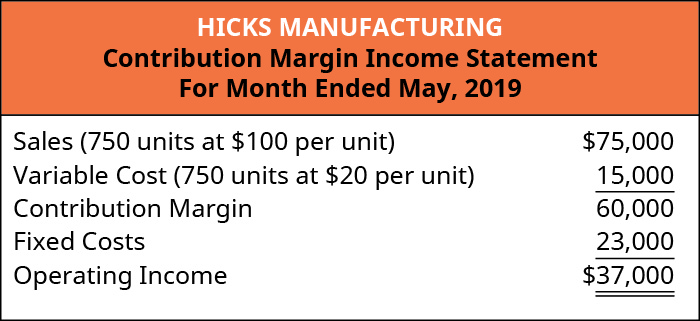

The contribution margin is the amount of money a business has to cover its fixed costs and contribute to net profit or loss after paying variable costs. The contribution margin can be calculated in dollars units or as a percentage. Contribution margin is a cost-accounting calculation that tells a company the profitability of an individual product or the revenue that is left after covering fixed costs.

Success in meeting budgeted goals for controllable costs. The contribution margin is when you deduct all connected variable costs from your products price which results in the incremental profit earned for each unit. The gross margin is computed as the difference between sales revenue and the cost of goods sold.

The contribution margin is the dollar amount of each unit of output that is available first to cover fixed costs and then to contribute to profit. View the full answer. Contribution margin is a great measure for adding or keeping products in your product portfolio.

Net income plus all fixed expenses equal the contribution margin. In accounting the terms sales and less its variable costs Fixed and Variable Costs Cost is something that can be classified in several ways depending on its nature. O the amount of food cost an item contributes to company food cost the amount of gross margin an item contributes to menu price.

The amount that startup costs contribute to the production of one unit. Total contribution margin is calculated by subtracting total variable costs from total revenues You have decided to start a lawn service business to help pay your tuition so that you can complete your undergraduate accounting degree. Amount of contribution margin generated by the profit center.

Question 4 Contribution margin is best described as o the amount of money an item contributes to company profits. Contribution margin is the revenue remaining after subtracting the variable costs that go into producing a product. The total contribution margin generated by an entity represents the total earnings available to pay for fixed expenses and to generate a profit.

Sales price per unit minus variable cost per unit. Contribution margin revenue variable costs. Which of the following best describes target costing.

Any existing products with a positive contribution margin should remain in. Amount of controllable margin generated by the profit center. In accounting contribution margin is defined as.

The contribution margin is normally shown in monetary terms. The best measure of the performance of the manager of a profit center is the a. How much the revenue from the sale of one unit contributes to overhead.

The contribution margin ratio is a formula that calculates the percentage of contribution margin fixed expenses or sales minus variable expenses relative to net sales put into percentage terms. This left-over value then contributes to paying the periodic fixed costs of the business with any remaining balance contributing profit to. The answer to this equation shows the total percentage of sales income remaining to cover fixed expenses and profit after covering all variable costs of producing a.

It also measures whether a product is generating enough revenue to pay for fixed costs and determines the profit it is generating. All fixed costs are grouped together and subtracted from gross profit. CThe contribution margin is defined as revenues minus fixed costs.

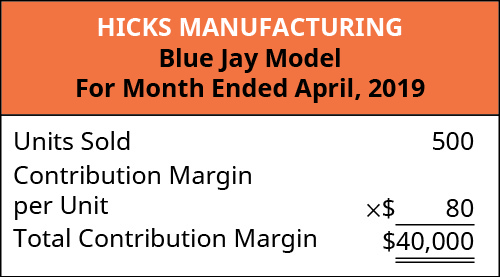

Contribution margin per unit is best described by which of the following. Contribution margin contributes to covering fixed costs and generating profits. Contribution margin per unit unit contribution margin Is the amount by which a products unit selling price exceeds its variable cost per unit.

This shows whether your company can cover variable costs with revenue. Contribution margin is a business sales revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. An Approach to pricing that begins with revenue at market price and subtracts desired profit to arrive at target total cost.

The total contribution margin is defined as the contribution margin multiplied by total revenues. O the amount of margin left on the item after trimming and cooking. The contribution margin is defined as fixed costs minus variable costs.

What is left over from the sale of one unit after subtracting variable costs. The contribution margin is the amount of per unit revenue that is available to first cover fixed costs and then to contribute to. Contribution margin is a products price minus all associated variable costs resulting in the incremental profit earned for each unit sold.

The contribution margin can be expressed as an amount andor as a ratio or percent of revenues. What is left over from the sale of one unit after subtracting fixed costs.

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

Contribution Margin Contribution Margin Learn Accounting Financial Analysis

0 Response to "Contribution Margin Is Best Described as:"

Post a Comment